Step Up Your Financial Journey With These To-Dos

The new year brings enthusiasm and a power toward pleasant sparkling goals for the year. It’s that point when you assess your existence and set out a new direction of motion for your bodily health, budget, forming new behavior, etc.

Revisiting an old way of lifestyles is a exquisite manner to chart out a direction for a new one, specifically concerning finance control. Here are a few steps you may take closer to your financial dreams for this year:

. Digital Bank Account:

The advantages of a digital savings account are manifold. Some of them are convenience and added safety. Now you may shift to the most secure digital financial institution, airtel payments financial institution, in which you could open a zero-balance account with a easy video call. Airtel Payments Bank offers a lucrative interest rate of up to 6% p.a. On saving deposits of over Rs. 1 lakh. And with deposits up to Rs 1 lakh, you may earn 2.5% interest consistent with annum.

. Numerous Investment Solutions:

At the same time as your portfolio is probably full of different monetary investments, parking your cash inside some low-risk options is a smart move. Airtel payments bank, in association with indusind bank, gives fixed deposits at appealing interest charges. Now book your constant deposits from Rs. 500 up to rs.1,90,000 at an interest price of up to 6.75% per annum through the airtel thanks app. Senior citizens get an additional 0.5% on all fixed deposits.

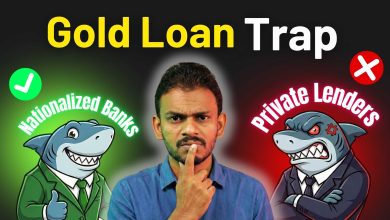

Besides fixed deposits, you may park your surplus funds into digi gold. Using airtel payments bank, you may purchase and sell 24 karat 99.50 percent 24-karat gold with out the problem of storing it in a bank locker or comparable safe location. The gold is sold for you, and you may are seeking its bodily transport at any time and on as many events as you want. You furthermore may have the ability of investing any quantity into digi gold – it could also be as low as Rs 1.

. Mindful Transactions:

Going digital means greater protection layers, and with the variety of online scams which have improved, you need to place your cash in which stringent safety features have been carried out. No cash leaves your account with out your consent whilst you open an account with airtel payments bank, way to the airtel safe pay characteristic. Through airtel network intelligence, you may receive signals about your transactions. 1/3-thing authentication has additionally been incorporated for upi and net banking transactions

Exploring a Rewards Program:

In the present day, purchasing has end up lots extra worthwhile. Incentives on purchases add to your revel in of selecting what you adore. With airtel payments bank, you can earn rewards on every transaction through the ‘rewards123’ programme.

A separate Account for Each day Transactions:

It is a good concept to break up your huge-price tag and every day transactions into distinctive money owed because using one single account can expose you to monetary dangers. For instance, getting into incorrect recipient details or the incorrect quantity can switch your entire savings to someone else. You may use your account within the airtel bills bank for all your every day transactions, and with airtel safepay, your cash received’t depart your account with out your consent. You will also be capable of clean the clutter of ordinary payments from your principal account and music your transactions in a better fashion.