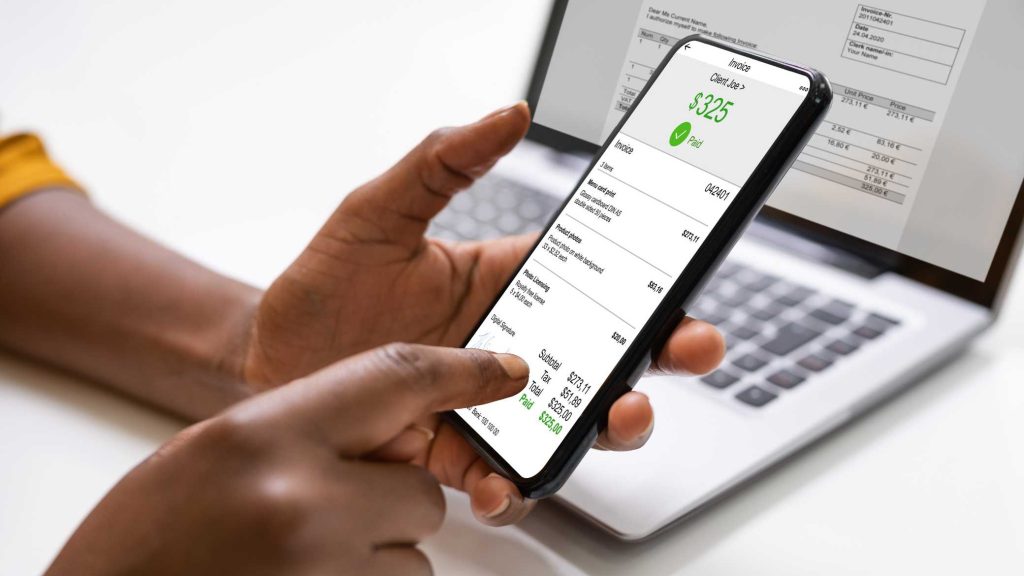

9 Best Payment Gateways of 2024: A Comprehensive Guide

Best Payment Gateways of 2024 : In the fast-evolving digital world, where online transactions are becoming increasingly commonplace, payment gateways have emerged as the backbone of e-commerce and financial transactions. Choosing the right payment gateway is critical for businesses looking to offer a seamless, secure, and user-friendly checkout experience.

Table of Contents

The year 2024 has brought a plethora of advancements in technology and security protocols, leading to innovative solutions in the payment industry. This essay explores the ten best payment gateways of 2024, highlighting their key features, benefits, and what sets them apart in a competitive market.

Buy Now :: Food Delivery Website With Free Android App

1. PayPal

PayPal continues to be a market leader in the payment gateway industry. Known for its reliability and global presence, it has consistently evolved to meet customer needs, making it one of the best choices for businesses and individual users alike in 2024.

- Global Reach: PayPal operates in over 200 countries and supports multiple currencies, making it ideal for international transactions.

- Ease of Use: PayPal’s user-friendly interface makes it easy for both sellers and buyers to process payments quickly.

- Security: It offers industry-leading security features, such as fraud detection, buyer protection, and data encryption.

- PayPal Checkout: This feature allows for streamlined payments on websites with just a few clicks, reducing cart abandonment rates.

In 2024, PayPal has enhanced its focus on cryptocurrency transactions, enabling users to buy, hold, and sell cryptocurrencies seamlessly within their accounts, catering to the growing interest in digital assets.

Also Read :: How Reselling Works ?

2. Stripe

Stripe has quickly established itself as a favorite among developers and e-commerce businesses due to its flexible and robust API solutions. In 2024, it remains a top choice for businesses looking for customizable payment solutions.

- Developer-Friendly: Stripe’s API allows for extensive customization, making it suitable for businesses with specific requirements.

- Global Capabilities: It supports over 135 currencies and multiple payment methods, including credit cards, digital wallets, and more.

- Advanced Analytics: Stripe offers in-depth analytics, allowing businesses to track payments, refunds, and subscription metrics.

- Fraud Prevention: Its Radar feature uses machine learning to detect and prevent fraud in real-time.

Stripe’s ability to offer tailored solutions makes it ideal for startups and tech-savvy enterprises that prioritize seamless integrations.

3. Adyen

Adyen is a popular payment gateway for global enterprises that require a single platform to accept payments anywhere. In 2024, it continues to lead with its innovative solutions and comprehensive payment services.

- Unified Commerce: Adyen offers a single platform for in-store, mobile, and online payments, creating a consistent customer experience.

- Risk Management: Its advanced risk management tools reduce fraud while increasing the conversion rate for legitimate transactions.

- Support for Multiple Payment Methods: Adyen supports over 250 payment methods, making it highly adaptable to local preferences.

- Data-Driven Insights: The platform provides valuable data and analytics, helping businesses understand customer behavior.

With strong partnerships and integrations, Adyen is a go-to choice for global brands looking to expand and optimize their payment operations.

4. Razorpay

Razorpay, an Indian payment gateway, has rapidly gained popularity in Asia and is a significant player in the fintech space. It is a comprehensive platform offering payment acceptance, payouts, and automation solutions.

- Instant Activation: Businesses can quickly set up and start accepting payments within minutes.

- Wide Range of Payment Methods: Razorpay supports payments through credit cards, debit cards, UPI, wallets, and more.

- Subscription Management: The platform offers tools for managing recurring payments with ease.

- Integrated Banking Solutions: RazorpayX provides banking features like payroll management, vendor payments, and more.

Razorpay’s ability to cater to small businesses and large enterprises alike has cemented its position as a leader in 2024.

5. Authorize.Net

One of the most well-established names in payment processing, Authorize.Net, continues to deliver dependable and secure services for small to medium-sized businesses.

- Security Features: Advanced fraud detection and robust data security make it one of the safest gateways available.

- Developer-Friendly APIs: Authorize.Net offers flexibility for businesses looking to integrate the gateway with custom applications.

- Recurring Billing: It provides tools for setting up and managing subscription-based billing models.

- Multiple Payment Options: The gateway supports credit cards, eChecks, Apple Pay, and more.

In 2024, Authorize.Net focuses on streamlining integrations with popular e-commerce platforms and expanding its customer support capabilities.

6. Braintree

A PayPal service, Braintree excels in providing advanced payment solutions for businesses that require flexibility, scalability, and international reach.

- Support for Diverse Payment Methods: Braintree enables businesses to accept cards, digital wallets (including Apple Pay and Google Pay), and even PayPal payments.

- Seamless Integration: It provides easy integration with e-commerce platforms and applications through powerful SDKs and APIs.

- Global Reach: Braintree operates in more than 45 countries and supports multiple currencies.

- Data Security: It offers fraud detection and compliance with the latest security standards, including PCI DSS.

Braintree is particularly favored by businesses that want to offer multiple payment options while maintaining security and performance.

Buy Now :: News & Magazine Website AI Automated

7. 2Checkout (now Verifone)

2Checkout, now operating under the Verifone brand, offers a comprehensive suite of payment solutions for online businesses, particularly those engaging in cross-border sales.

- Subscription Billing: 2Checkout offers tools for managing subscription-based businesses with flexible billing cycles and customer engagement features.

- Localized Experience: It supports 45+ payment methods and provides localized checkout experiences in multiple languages.

- Fraud Protection: Built-in fraud prevention tools ensure secure transactions.

- Multiple Currencies: It supports transactions in 200+ countries and territories.

Verifone’s ability to handle complex cross-border transactions makes it a top pick for global merchants in 2024.

8. Amazon Pay

Amazon Pay leverages the trust and familiarity associated with Amazon to offer a convenient payment solution for both merchants and customers.

- Easy Checkout: Amazon users can pay using their stored payment information without needing to re-enter details.

- Trust and Security: Transactions are backed by Amazon’s security infrastructure.

- Integration with Voice Shopping: Amazon Pay works with Alexa, enabling voice-based shopping and payment experiences.

- Global Reach: It allows businesses to reach millions of Amazon customers globally.

Amazon Pay is particularly advantageous for e-commerce businesses looking to tap into the vast Amazon ecosystem and its loyal customer base.

19. Klarna

Klarna has gained significant traction in 2024, thanks to its “buy now, pay later” (BNPL) services and flexible payment options that appeal to consumers.

- Flexible Payment Solutions: Klarna offers payment plans, such as splitting the cost into interest-free installments, making it attractive for shoppers.

- Merchant Tools: The platform provides analytics and customer engagement tools to drive sales.

- Seamless Checkout Experience: Klarna’s one-click checkout simplifies the purchasing process, reducing cart abandonment.

- Global Availability: It operates in multiple markets, making it suitable for international businesses.

Klarna’s focus on customer-centric payment options has positioned it as a preferred payment gateway for retailers aiming to increase conversions.

Best Payment Gateways of 2024 – Conclusion

The best payment gateways of 2024 offer an array of features that cater to the diverse needs of businesses across the globe. From traditional players like PayPal and Authorize.Net to newer entrants like Klarna and Razorpay, businesses have a wealth of options when it comes to choosing a payment gateway. The ideal choice depends on factors like the scale of operations, target markets, preferred payment methods, and the level of customization required.

Buy Now :: Ecommerce Website With 100 Products

As digital payments continue to evolve, businesses must stay informed about the latest features, security protocols, and innovations offered by leading payment gateways to ensure seamless, secure, and satisfying customer experiences. Whether it’s for global e-commerce enterprises, local retailers, or subscription-based businesses, there is a payment gateway designed to meet every need.

Keywords : Best Payment Gateways of 2024 – Best Payment Gateways of 2024 List – Best Payment Gateways of 2024 For You