Best SIP for Long Term – Invest ₹5000 | Earn ₹5.22 Crore – SIP Investment

Best SIP for Long Term

In the pursuit of becoming a crorepati and attaining significant wealth, Systematic Investment Plans (SIPs) in mutual funds stand out as one of the most reliable and disciplined investment strategies. This comprehensive guide will delve into how you can leverage SIPs to accumulate substantial wealth over the long term, with a particular focus on investing ₹5000 monthly to potentially earn ₹5.22 crore.

Table of Contents

Setting Clear Financial Goals

The foundation of any successful investment strategy is setting clear, achievable financial goals. Before diving into SIP investments, it is essential to define what you want to achieve. Are you saving for your retirement, your children’s education, a dream home, or financial independence? Your goals will determine the type of SIPs you choose, the duration of your investment, and your risk tolerance.

Aligning SIPs with Risk Tolerance and Investment Horizon

Understanding your risk tolerance is crucial. SIPs offer various options ranging from equity funds, which are high risk but potentially high return, to debt funds, which are lower risk and offer more stability. Your investment horizon – the time you plan to stay invested – also plays a critical role. For long-term goals (over 10-15 years), equity SIPs are generally recommended due to their potential for higher returns.

Aslo Read… Invest 405 Rs and Earn 1 Crore – Public Provident Fund India

The Power of Early and Consistent Investment

One of the golden rules of investing is to start early. The earlier you start investing, the more time your money has to grow. Compounding – earning returns on both your initial investment and the returns accumulated over time – works best when given time. Starting early and investing consistently can significantly increase your chances of building substantial wealth.

Utilizing SIP Step-Up Features

A key strategy to maximize your SIP investment is to utilize the SIP step-up feature. This allows you to increase your SIP contribution annually. For instance, if you start with a monthly SIP of ₹5000 and increase it by 15 percent every year, your investment grows significantly faster than a fixed monthly contribution. This incremental approach takes advantage of rising incomes and inflation, enabling you to invest more as you earn more.

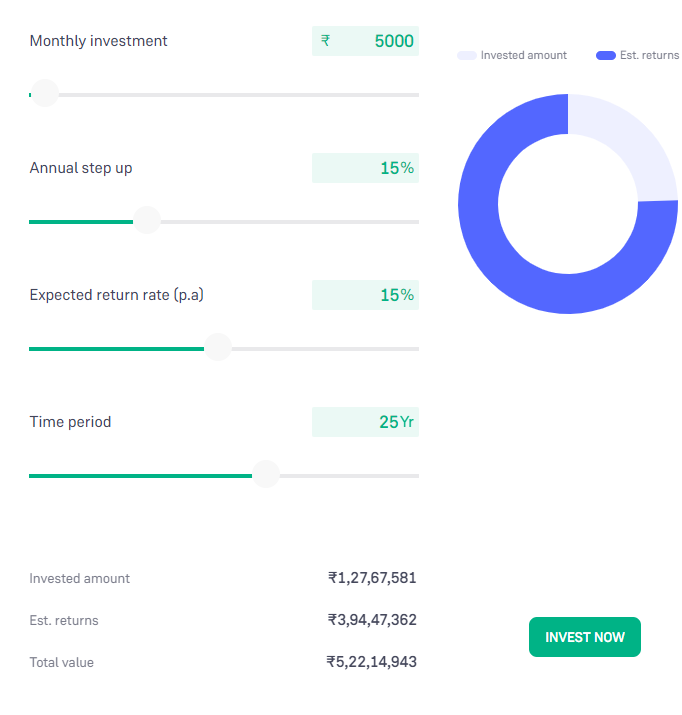

Mutual Fund SIP Calculator: A Tool for Planning

To understand how your investments can grow, using a mutual fund SIP calculator is highly beneficial. This tool allows you to input your monthly SIP amount, expected annual return, and the duration of your investment to project the future value of your investments.

Example Calculation

Let’s consider a practical example to illustrate how you can accumulate ₹5.22 crore over 25 years with disciplined SIP investing:

- Initial Monthly SIP: ₹5000

- Annual SIP Step-Up: 15%

- Expected Annual Return: 15%

With these inputs, a mutual fund SIP calculator will show that you can potentially accumulate around ₹5.22 crore over 25 years. The consistent investment, combined with annual increases and compounding returns, can transform modest monthly contributions into substantial wealth.

Discipline and Commitment: The Pathway to Wealth

Discipline and commitment are crucial when investing in SIPs. Market fluctuations are inevitable, but staying committed to your investment plan through market ups and downs is essential. Avoid the temptation to withdraw or stop your SIP during market downturns, as this can hinder the compounding effect and reduce your potential returns.

Benefits of SIPs

- Rupee Cost Averaging: SIPs allow you to invest a fixed amount regularly, buying more units when prices are low and fewer units when prices are high. This strategy averages out the cost of your investments over time, reducing the impact of market volatility.

- Compounding Returns: The longer you stay invested, the more your returns compound. Reinvesting your returns can significantly boost your investment value over time.

- Flexibility: SIPs offer flexibility in terms of investment amount and frequency. You can start with a small amount and gradually increase it as your income grows.

- Financial Discipline: Regular SIP investments instill financial discipline, encouraging you to save and invest consistently.

- Professional Management: Mutual funds are managed by professional fund managers who have the expertise to make informed investment decisions on your behalf.

Long-Term Wealth Accumulation

Investing in SIPs for the long term requires patience and perseverance. The journey to becoming a crorepati is not without its challenges, but with a well-thought-out plan and consistent execution, it is achievable.

Key Considerations for Long-Term SIP Investment

- Choose the Right Funds: Select mutual funds that align with your financial goals and risk tolerance. Equity funds are generally suitable for long-term growth, while debt funds provide stability.

- Regularly Review Your Portfolio: Periodically review your investment portfolio to ensure it remains aligned with your goals. Rebalance your portfolio if necessary to maintain the desired asset allocation.

- Stay Informed: Keep yourself informed about market trends, economic conditions, and changes in the mutual fund industry. This knowledge will help you make better investment decisions.

- Consult Financial Advisors: If you are unsure about your investment choices, seek advice from financial advisors. They can provide personalized recommendations based on your financial situation and goals.

Overcoming Common Challenges

- Market Volatility: Market volatility can be unnerving, but it is essential to stay focused on your long-term goals. SIPs are designed to mitigate the impact of market fluctuations through rupee cost averaging.

- Financial Emergencies: In case of financial emergencies, instead of stopping your SIP, consider pausing it temporarily. Many mutual funds offer a pause option, allowing you to resume investments once your situation stabilizes.

- Emotional Bias: Emotional decisions can negatively impact your investment strategy. Stick to your plan and avoid making impulsive changes based on short-term market movements.

Conclusion

Systematic Investment Plans (SIPs) offer a disciplined and effective approach to long-term wealth accumulation. By investing ₹5000 monthly and leveraging features like SIP step-up, you can potentially accumulate ₹5.22 crore over 25 years. The key to success lies in setting clear financial goals, starting early, investing consistently, and staying committed to your plan despite market fluctuations.

Utilizing tools like the mutual fund SIP calculator can help you project the future value of your investments and make informed decisions. Additionally, selecting the right mutual funds, regularly reviewing your portfolio, and seeking professional advice can enhance your investment journey.

In conclusion, SIPs provide a pathway to achieving financial goals and becoming a crorepati through disciplined and consistent investing. With the right strategy and mindset, you can harness the power of compounding and rupee cost averaging to build substantial wealth over the long term. Start your SIP journey today and take the first step towards financial freedom and prosperity.