Income Tax Rebate : Confused About New Income Tax Rebate Till ₹12 lakh? New Slabs Simplified

Income Tax Rebate : The Union Budget 2025 introduced a significant revision to India’s income tax structure, providing substantial relief to the middle-class taxpayers. One of the most noteworthy announcements by Finance Minister Nirmala Sitharaman was that individuals earning up to ₹12 lakh per annum will not be required to pay income tax under the new tax regime.

Table of Contents

However, this declaration has led to considerable confusion, particularly because the revised tax slabs still display tax rates for incomes up to ₹12 lakh. To clarify this, it is essential to analyze the newly introduced tax slabs, the mechanism of the rebate, and its implications for different income groups.

Revised Income Tax Slabs for FY 2025-26

The new tax structure introduced the following slabs:

- Income up to ₹4 lakh: No tax

- Income between ₹4 lakh – ₹8 lakh: 5% tax

- Income between ₹8 lakh – ₹12 lakh: 10% tax

- Income between ₹12 lakh – ₹16 lakh: 15% tax

- Income between ₹16 lakh – ₹20 lakh: 20% tax

- Income between ₹20 lakh – ₹24 lakh: 25% tax

- Income above ₹24 lakh: 30% tax

Comparison with the Previous Tax Slabs (FY 2024-25)

For context, the old tax slabs were structured as follows:

- Income up to ₹3 lakh: No tax

- Income between ₹3 lakh – ₹7 lakh: 5% tax

- Income between ₹7 lakh – ₹10 lakh: 10% tax

- Income between ₹10 lakh – ₹12 lakh: 15% tax

- Income between ₹12 lakh – ₹15 lakh: 20% tax

- Income above ₹15 lakh: 30% tax

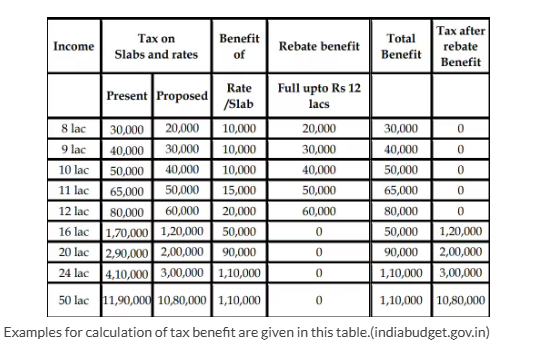

The revised tax slabs indicate that while tax rates have been adjusted, the core difference lies in the introduction of a tax rebate mechanism that ensures individuals earning up to ₹12 lakh do not actually pay any tax.

How the Rebate Works

A key source of confusion has been the continued presence of tax rates for income brackets up to ₹12 lakh, despite the announcement that no tax will be payable for those earning within this range.

Also Read : Loan Through Aadhaar Card : How to Get a Rs 20,000 Loan Using Aadhaar Card

The government has addressed this by offering a rebate that nullifies any tax liability for individuals with incomes up to ₹12 lakh.

To illustrate this, consider a taxpayer earning ₹12 lakh annually. Based on the revised tax slabs, their taxable income is calculated as follows:

- Income up to ₹4 lakh: No tax

- Income between ₹4 lakh – ₹8 lakh: 5% on ₹4 lakh = ₹20,000

- Income between ₹8 lakh – ₹12 lakh: 10% on ₹4 lakh = ₹40,000

- Total tax liability: ₹60,000

However, under the new tax regime, a rebate is provided that cancels out this entire ₹60,000 tax liability, ensuring that individuals with incomes up to ₹12 lakh effectively pay zero tax. This rebate mechanism is the core of the relief provided under the new system.

Impact on Higher Income Groups

For individuals earning above ₹12 lakh, the rebate does not apply beyond this threshold, meaning they will be taxed on the excess income. For instance, consider an individual earning ₹16 lakh per annum. Their tax calculation would be:

- Income up to ₹4 lakh: No tax

- Income between ₹4 lakh – ₹8 lakh: 5% on ₹4 lakh = ₹20,000

- Income between ₹8 lakh – ₹12 lakh: 10% on ₹4 lakh = ₹40,000

- Income between ₹12 lakh – ₹16 lakh: 15% on ₹4 lakh = ₹60,000

- Total tax payable: ₹1,20,000

Thus, the tax structure remains progressive, ensuring that higher earners contribute proportionally while providing significant relief to lower and middle-income earners.

Implications of the New Tax Regime

The government’s primary objective with this reform is to boost disposable income, particularly for middle-class taxpayers. By exempting income up to ₹12 lakh from taxation, more money is left in the hands of consumers, which can enhance spending, savings, and investment. This move aligns with the broader economic vision of the Narendra Modi-led government, which aims to stimulate economic activity while simplifying the tax process.

Additionally, the streamlined tax slabs make compliance easier and reduce ambiguities in tax calculations. Unlike the old tax regime, which involved multiple exemptions and deductions, the new system focuses on straightforward tax rates with the provision of an automatic rebate.

Income Tax Rebate – Conclusion

The revision of income tax slabs in the Union Budget 2025 is a landmark move in India’s taxation policy, aiming to provide relief to the middle class while ensuring fiscal responsibility. While initial confusion arose due to the continued presence of tax rates within the ₹12 lakh range, the rebate mechanism ensures that individuals within this bracket ultimately pay no tax.

Buy Now : Options Trading Master Class

For taxpayers earning above ₹12 lakh, progressive taxation remains in place, ensuring equitable contributions. With this reform, the government is fostering a simpler, more transparent, and taxpayer-friendly system, ultimately encouraging economic growth and financial well-being for millions of Indians.