Mutual Fund SIP – Invest 500 Rs Daily, Earn 1 Crore | SIP Investment

Mutual Fund SIP

Mutual Fund SIPs allow investors to contribute small amounts regularly, making it an accessible and disciplined approach to investing. This essay explores the benefits of investing 500 Rs daily in a mutual fund SIP, the power of compounding, and the potential to accumulate 1 crore over a period of 15 years.

Table of Contents

What is a Mutual Fund Systematic Investment Plan (Mutual Fund SIP)?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount of money in mutual funds at regular intervals, typically monthly. This approach helps investors inculcate a disciplined saving habit, reduce market timing risks, and benefit from the power of compounding. By spreading investments over time, mutual fund SIPs can mitigate the impact of market volatility and enable investors to build a substantial corpus in the long run.

The Investment Strategy: 500 Rs Daily

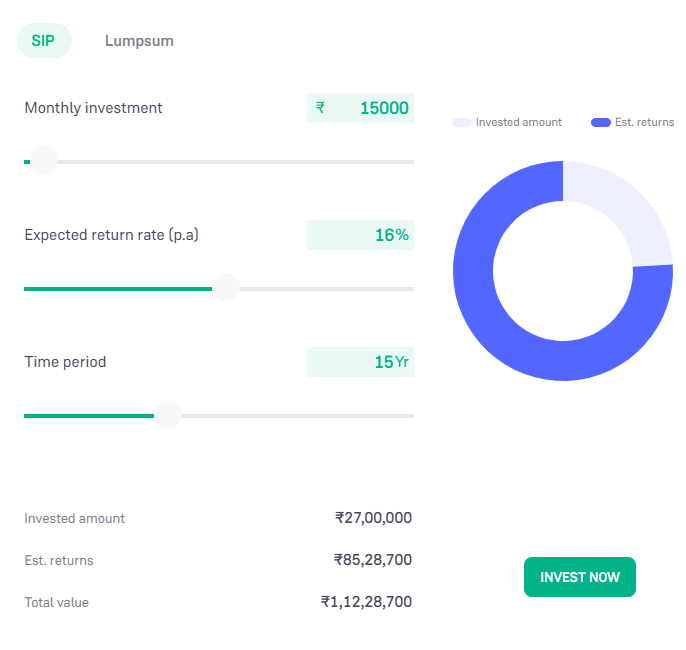

The proposed investment strategy involves investing 500 Rs daily, which translates to 15,000 Rs monthly. This approach is manageable for many individuals and can be incorporated into their regular financial planning. Investing 500 Rs daily may seem modest, but it can yield significant returns over time due to the magic of compounding.

To understand the potential of this strategy, let’s break down the key components:

- Monthly Investment: ₹15,000

- Expected Return Rate (p.a.): 16%

- Time Period: 15 years

Using these parameters, we can calculate the total invested amount, estimated returns, and total value of the investment after 15 years.

Also Read… Invest 100 Rs and Earn 30 Crore After 30 Years

Power of Compounding

Compounding is the process where the returns on an investment generate additional returns over time. In other words, the interest earned on the initial investment also earns interest, leading to exponential growth. Albert Einstein once referred to compounding as the “eighth wonder of the world,” highlighting its profound impact on wealth accumulation.

In the context of SIPs, compounding works as follows:

- Each installment invested earns returns.

- The returns are reinvested and start generating their own returns.

- Over time, the investment grows exponentially as both the principal and the accumulated returns generate further returns.

Mutual Fund SIP Calculator: Projections

Using a mutual fund SIP calculator, we can project the growth of the investment over 15 years. The expected return rate is assumed to be 16% per annum, which is a reasonable estimate for equity mutual funds based on historical performance.

Monthly Investment: ₹15,000

Expected Return Rate (p.a.): 16%

Time Period: 15 years

Invested Amount: ₹27,00,000

Estimated Returns: ₹85,28,700

Total Value: ₹1,12,28,700

Let’s delve deeper into each component:

- Invested Amount: This is the total sum invested over the 15-year period. Investing 15,000 Rs monthly for 15 years results in an invested amount of ₹27,00,000.

- Estimated Returns: The returns generated on the invested amount, assuming a 16% annual return rate, accumulate to ₹85,28,700.

- Total Value: The sum of the invested amount and the estimated returns gives the total value of the investment, which is ₹1,12,28,700.

These projections highlight the potential of accumulating over 1 crore through disciplined SIP investments over 15 years.

Benefits of Mutual Fund SIP Investments

Investing through SIPs offers several advantages:

- Discipline and Regularity: SIPs instill a disciplined saving habit by automating the investment process. Regular contributions ensure that investors remain committed to their financial goals.

- Rupee Cost Averaging: SIPs take advantage of market fluctuations by buying more units when prices are low and fewer units when prices are high. This averaging effect can reduce the overall cost per unit and enhance returns.

- Flexibility: Investors can start SIPs with small amounts, adjust the contribution amount, and stop or pause investments if needed. This flexibility makes SIPs suitable for investors with varying financial capacities.

- Power of Compounding: As discussed, the reinvestment of returns leads to exponential growth over time, maximizing wealth accumulation.

- Convenience: SIPs are easy to set up and manage, requiring minimal effort from the investor. Automated deductions from the bank account ensure timely investments.

Factors to Consider

While mutual fund SIPs offer numerous benefits, there are several factors investors should consider:

- Investment Horizon: SIPs are most effective over the long term. A minimum investment horizon of 5-10 years is recommended to fully benefit from compounding and rupee cost averaging.

- Risk Tolerance: The chosen mutual fund should align with the investor’s risk tolerance. Equity mutual funds offer higher returns but come with greater volatility. Balanced or debt funds may be more suitable for conservative investors.

- Fund Selection: It is crucial to select a mutual fund with a proven track record, strong management, and consistent performance. Diversification across different funds and asset classes can also mitigate risks.

- Market Conditions: While SIPs help mitigate market timing risks, investors should stay informed about market conditions and economic factors that may impact returns.

- Regular Review: Periodic review of the investment portfolio is essential to ensure it remains aligned with financial goals and market conditions. Adjustments may be needed based on performance and changing objectives.

Conclusion

Investing 500 Rs daily in a mutual fund SIP is a powerful strategy for achieving financial independence and wealth creation. By committing to a disciplined investment approach, leveraging the power of compounding, and benefiting from rupee cost averaging, investors can accumulate substantial wealth over time. The projections based on a 15-year investment horizon and a 16% annual return rate demonstrate the potential to grow a modest daily investment into a corpus exceeding 1 crore.