Option Trading – Earn Huge Amount With Option Buying – 1:10 Option Trading Strategy

Option Trading

Introduction to Option Trading

Option trading has emerged as a popular financial instrument for both novice and seasoned traders. The allure of potentially high returns draws many into the world of options. However, the complexity and risks involved often deter those unfamiliar with its intricacies. This essay aims to demystify option trading, particularly option buying, and introduce an effective strategy the 1:10 option trading strategy.

Table of Contents

Understanding Option Trading

Option trading involves buying and selling options, which are financial derivatives that give buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specific date. There are two types of options: call options, which allow the purchase of an asset, and put options, which allow the sale of an asset.

The primary appeal of option trading lies in its leverage potential. With a relatively small investment, traders can control a large position, leading to substantial profits if the trade goes as anticipated. However, this leverage also means that losses can be significant if the market moves against the trader.

Why Choose Option Buying?

Option buying, as opposed to option selling, is particularly attractive for traders seeking high returns. When you buy an option, you are not exposed to unlimited risk. The maximum loss is limited to the premium paid for the option. This fixed risk makes option buying a preferred choice for many traders, especially those starting in the options market.

Also Read….. Blogging – Earn Monthly 30,000 Rs Without Any Investment

The Challenge of Learning Option Trading

The primary challenge for aspiring option traders is understanding how to study and implement effective trading strategies. The options market is complex, and without proper knowledge, the risk of losses is high. This is where educational resources come into play.

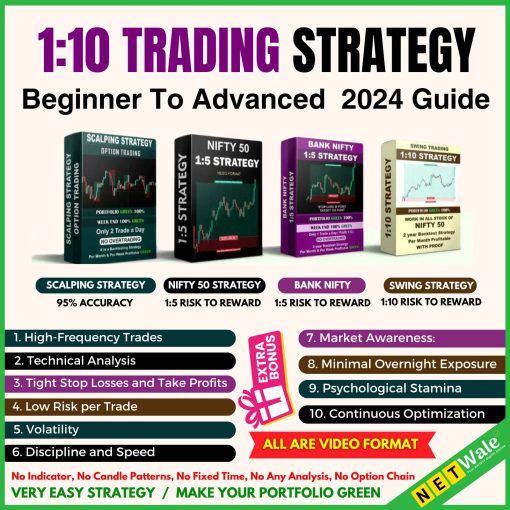

Introducing “Beginner to Advanced Option Trading Strategy 2024” by Netwale

To address the educational gap, Netwale has introduced a comprehensive course titled “Beginner to Advanced Option Trading Strategy 2024”. This course is designed to take traders from the basics of option trading to advanced strategies that can significantly enhance their trading performance. Here’s a detailed look at what the course offers:

Features of the Course

- Scalping Strategy: 95% Accuracy

- Scalping is a trading strategy that involves making multiple trades within a short time frame to capitalize on small price movements. The course offers a scalping strategy with a remarkable 95% accuracy rate, making it a reliable approach for quick gains.

- Nifty 50 Strategy: 1:5 Risk to Reward

- This strategy is tailored for trading Nifty 50 options. It offers a 1:5 risk to reward ratio, meaning that for every unit of risk, there is a potential reward of five units. Such a favorable risk to reward ratio is ideal for traders looking to maximize their profits while minimizing risk.

- Bank Nifty: 1:5 Risk to Reward

- Similar to the Nifty 50 strategy, the Bank Nifty strategy also offers a 1:5 risk to reward ratio. This strategy focuses on the banking sector index, which is known for its volatility and profit potential.

- Swing Strategy: 1:10 Risk to Reward

- The swing strategy aims to capture gains from short to medium-term price movements. With a 1:10 risk to reward ratio, this strategy provides an opportunity for substantial profits, making it a cornerstone of the course.

- All in Video Format

- The entire course is delivered in video format, allowing for an engaging and comprehensive learning experience. Visual aids and practical demonstrations help in better understanding and retention of concepts.

- Chart Patterns

- Understanding and interpreting chart patterns is crucial for successful trading. The course includes detailed lessons on various chart patterns, enabling traders to make informed decisions based on technical analysis.

Bonus Courses Included

In addition to the main course content, Netwale offers five bonus courses that cover various aspects of trading and market analysis. These bonus courses add significant value, providing a well-rounded education for aspiring traders.

Course Specifications

- File Size: 8.85 GB

- Language: English and Hindi

The course content is substantial, ensuring that learners have access to a wealth of information and resources to aid their trading journey.

Implementing the 1:10 Option Trading Strategy

The 1:10 option trading strategy is particularly noteworthy for its potential to generate high returns. Here’s a detailed look at how to implement this strategy:

- Identify Opportunities: Look for trading opportunities where the potential reward is ten times the risk. This involves analyzing market trends, news, and technical indicators.

- Set Entry and Exit Points: Clearly define your entry and exit points based on your analysis. This helps in minimizing risk and maximizing potential gains.

- Use Technical Analysis: Leverage chart patterns and technical indicators to identify potential price movements. Tools like moving averages, Bollinger Bands, and the Relative Strength Index (RSI) can be particularly useful.

- Manage Risk: Effective risk management is crucial. Only invest a small portion of your capital in each trade and use stop-loss orders to limit potential losses.

- Stay Informed: The options market is dynamic, and staying informed about market trends, economic news, and geopolitical events is essential for successful trading.

Legal and Regulatory Considerations

Before diving into option trading, it is essential to understand the legal and regulatory requirements. Here are the key considerations:

- Regulatory Compliance: Ensure that your trading activities comply with the regulations set by the Securities and Exchange Board of India (SEBI). This includes adhering to margin requirements and reporting standards.

- Trading Account: Open a trading account with a registered brokerage firm. Ensure that the broker offers options trading and has a robust platform for executing trades.

- Taxation: Understand the tax implications of option trading. Profits from trading are subject to capital gains tax, and it is essential to maintain accurate records of all transactions for tax purposes.

- Risk Disclosure: Be aware of the risks involved in option trading. Most brokers require traders to sign a risk disclosure statement acknowledging the potential risks.

Conclusion

Option trading, particularly option buying, offers significant profit potential. However, it requires a thorough understanding of market dynamics, effective strategies, and risk management practices. The “Beginner to Advanced Option Trading Strategy 2024” course by Netwale provides a comprehensive education on these aspects, equipping traders with the knowledge and tools needed for success.

By implementing strategies like scalping, Nifty 50, Bank Nifty, and the 1:10 swing strategy, traders can maximize their returns while managing risks. Additionally, understanding the legal and regulatory landscape ensures compliance and smooth trading operations.