Pay Later Apps – Shop Now, Pay the Bill Later – Best 4 Apps- Pre Loans

Pay Later Apps

pay later apps have emerged as indispensable tools for modern consumers. These innovative platforms empower users to shop now and pay the bill later, providing a seamless shopping experience while offering flexible repayment options. Among the myriad options available, four stand out for their unique features and benefits: Postpe, Simpl, Freo Pay, and ShopSe. This essay delves into the intricacies of each platform, exploring their loan terms, repayment options, and the overarching advantages they bring to users.

Table of Contents

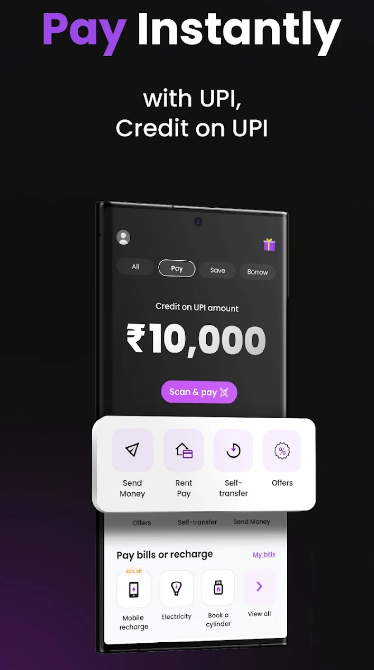

1) Postpe

Redefining Convenience and Flexibility Postpe revolutionizes the pay later apps experience with its array of features designed to enhance convenience and flexibility. Users can scan and pay using their Postpe credit limit at any BharatPe QR codes, streamlining the payment process while earning cashbacks and rewards. With credit lines ranging from ₹1,000 to ₹10,00,000 and flexible tenure options of up to 15 months, Postpe offers users the freedom to manage their finances on their own terms. Additionally, the option to convert bills into easy EMIs further enhances affordability, making Postpe a preferred choice among discerning consumers.

Also Read.. Get 5 Lakh Instant Loan With 0% Rate For 1 Month – Slice Pay Later Apps

- Users can scan and pay at BharatPe QR codes using their Postpe credit limit.

- Credit lines range from ₹1,000 to ₹10,00,000 with tenure options up to 15 months.

- No collateral required, and users can earn cashbacks and rewards.

- Bills can be converted into easy EMIs for enhanced affordability.

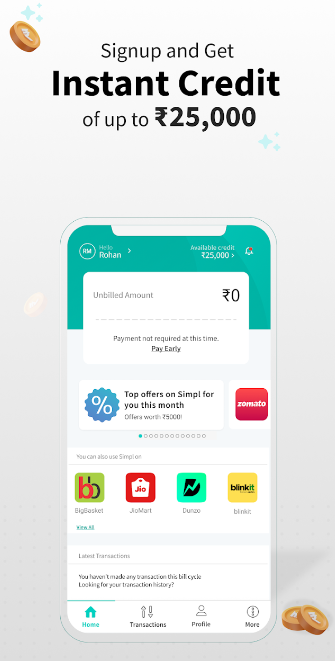

2) Simpl

Streamlining Payments with Split Pay Simpl simplifies the payment process with its innovative Split Pay feature, allowing users to complete their payments in three parts over two months without any interest or hidden charges. This unique offering enables users to spread their expenses over time, easing the burden of lump-sum payments and enhancing budget management. By providing transparency and flexibility in repayment, Simpl empowers users to shop with confidence while maintaining financial discipline.

- Offers the Split Pay feature, allowing users to complete payments in three parts over two months.

- No interest or hidden charges, promoting transparency and budget management.

- Provides a seamless shopping experience with flexible repayment options.

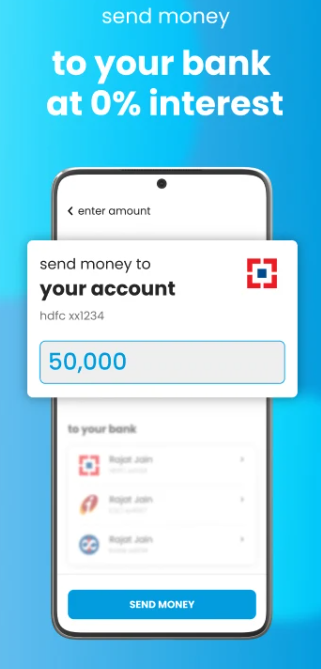

3) Freo Pay

Instant Access to Funds with Zero Interest Freo Pay stands out for its instant access to funds of up to ₹10,000, offering users the flexibility to meet their immediate financial needs without any interest for the first 30 days of every month. With loan amounts ranging from ₹3,000 to ₹5 lakhs and competitive interest rates of 12% to 36% per annum, Freo Pay caters to a wide spectrum of financial requirements. Moreover, its APR range of 10% to 70% ensures transparency and affordability, making it a preferred choice among users seeking quick and convenient access to funds.

- Instant access to funds of up to ₹10,000 with zero interest for the first 30 days of every month.

- Loan amounts range from ₹3,000 to ₹5 lakhs with competitive interest rates.

- APR ranges from 10% to 70%, ensuring transparency and affordability.

- Catering to diverse financial needs with flexible repayment tenures.

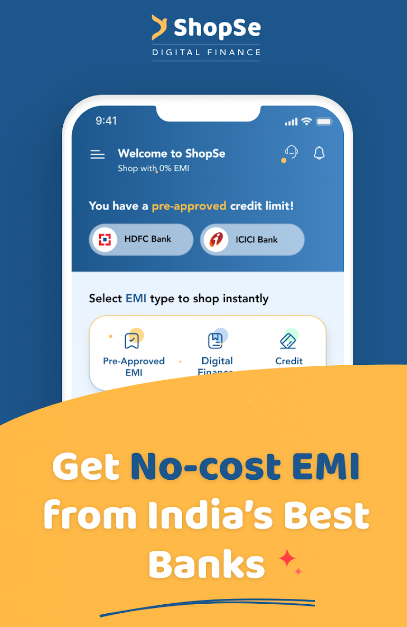

4) ShopSe

Seamless Shopping Experience with No Cost EMIs ShopSe enhances the shopping experience by providing instant EMIs for purchases at favorite shops and e-stores, allowing users to shop instantly and pay later apps in easy, no-cost EMIs. This convenient offering eliminates the need for upfront payments, enabling users to indulge in their favorite purchases without straining their finances. With ShopSe, users can enjoy the flexibility of paying in installments while availing themselves of attractive deals and discounts, making shopping a hassle-free and rewarding experience.

Also Read… Snapmint – Without CIBIL Score | 19 Rs Down payment | Buy all Products

- Offers instant EMIs for purchases at favorite shops and e-stores.

- Enables users to shop instantly and pay later in easy, no-cost EMIs.

- Eliminates the need for upfront payments, enhancing affordability and convenience.

- Users can enjoy attractive deals and discounts while spreading their payments over time.

Conclusion

In conclusion, pay later apps have transformed the way consumers shop and manage their finances, offering unparalleled convenience and flexibility. Platforms like Postpe, Simpl, Freo Pay, and ShopSe exemplify the evolution of financial technology, providing users with innovative solutions to meet their diverse needs. Whether it’s streamlining payments, accessing instant funds, or enjoying no-cost EMIs, these platforms empower users to take control of their finances and embrace a more convenient and rewarding shopping experience. As the landscape of pay later apps continues to evolve, one thing remains clear: the future of retail lies in the hands of those who embrace innovation and adapt to the changing needs of consumers.