SIP Investment – Deposit ₹50 and Become a Millionaire

SIP Investment

the power of disciplined and strategic investing can turn even small daily savings into significant wealth over time. One such investment strategy is the Systematic Investment Plan (SIP), which allows individuals to invest small amounts regularly in mutual funds. This essay explores how investing ₹50 daily in an SIP can potentially accumulate ₹1 crore over a span of 30 years, illustrating the magic of compounding and disciplined investment.

Table of Contents

The Desire to Become a Crorepati

The aspiration to earn ₹1 crore is universal, transcending age and income brackets. Many people wonder how they can amass such a large sum while managing monthly expenses on a limited salary. The answer lies in disciplined saving and long-term investment. Investing ₹50 daily may seem insignificant, but when done consistently over time, it can lead to substantial wealth, thanks to the power of compounding.

The Concept of Long-Term Investment

The principle of “Palatulli Peruvelam” suggests that even small contributions can grow into a significant amount over time. By setting aside a modest sum like ₹50 daily, one cannot become a millionaire overnight. However, with patience and the right investment strategy, such as an SIP, it is possible to accumulate ₹1 crore over a long period. This essay will delve into the mechanics of SIPs and how they can help achieve this financial goal.

Understanding SIP Investment (Systematic Investment Plan)

What is SIP?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where an individual invests a fixed amount regularly, usually monthly. This approach allows investors to purchase units of mutual funds at different market levels, averaging out the cost of investment over time. SIPs have gained popularity due to their simplicity, affordability, and the benefits of rupee cost averaging and compounding returns.

Why Choose SIP?

There are numerous investment schemes available, but SIPs stand out for several reasons:

- Affordability: SIPs allow investments with as little as ₹500 per month, making them accessible to a broad range of investors.

- Discipline: SIPs encourage regular saving and investment habits, crucial for long-term wealth creation.

- Rupee Cost Averaging: By investing a fixed amount regularly, investors buy more units when prices are low and fewer units when prices are high, averaging out the purchase cost.

- Compounding Returns: SIPs benefit from the power of compounding, where the returns on investment generate further returns, leading to exponential growth over time.

Also Read… SIP Investment… Invest 500 Rs & Earn 66,17,194 Rs

Expected Returns

SIPs have historically provided returns in the range of 12-14% per annum. This return, coupled with the benefit of compounding, can significantly enhance the value of the invested amount over a long period.

The Journey from ₹50 Daily to ₹1 Crore

The Plan

To illustrate the power of SIP, let’s consider a scenario where a 30-year-old individual starts investing ₹50 daily, equivalent to ₹1,500 monthly, in an SIP. The goal is to accumulate ₹1 crore by the time they reach the age of 60. Here’s a closer look at how this investment plan can achieve the target.

Yearly Investment and Returns

Investment Calculation:

- Daily Investment: ₹50

- Monthly Investment: ₹1,500 (₹50 * 30 days)

- Annual Investment: ₹18,000 (₹1,500 * 12 months)

Expected Returns:

- Average Annual Return: 14%

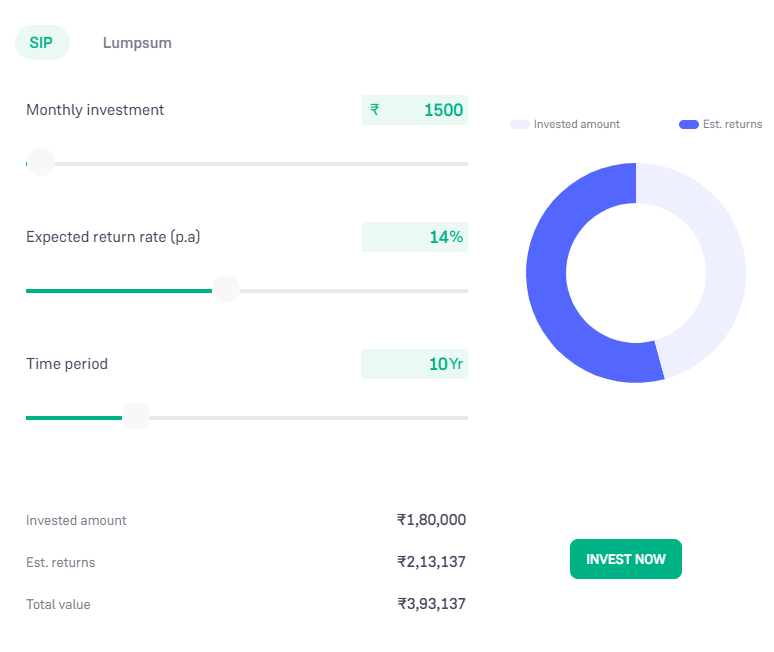

10-Year Projection:

- Total Investment: ₹1,80,000 (₹18,000 * 10 years)

- Long-Term Capital Gain: ₹2,13,137

- Total Savings: ₹3,93,137

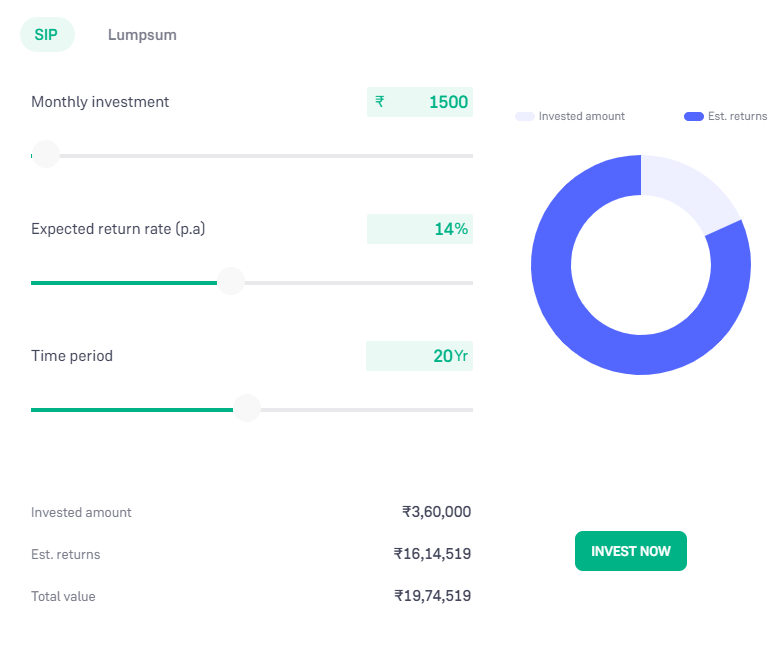

20-Year Projection:

- Total Investment: ₹3,60,000 (₹18,000 * 20 years)

- Long-Term Capital Gain: ₹16,14,519

- Total Savings: ₹19,74,519

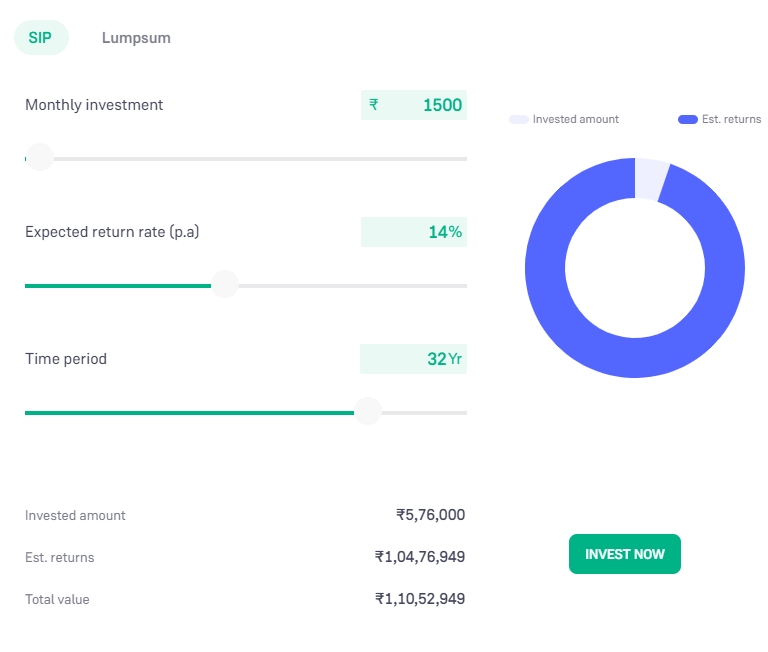

32-Year Projection:

- Total Investment: ₹5,76,000 (₹18,000 * 32 years)

- Long-Term Capital Gain: ₹1,04,76,949

- Total Savings: ₹1,10,52,949

Achieving ₹1 Crore

From the above projections, it is evident that with a disciplined approach and regular investment of ₹50 daily, it is possible to accumulate over ₹1 crore in 32 years. The key to achieving this goal lies in the consistent application of the SIP strategy and the magic of compounding returns.

Also Read… SIP Investment – Invest 30,000Rs And Get 1 Crore

The Power of Compounding

Understanding Compounding

Compounding is the process where the returns on an investment generate additional returns over time. It is often described as the “eighth wonder of the world” due to its ability to grow wealth exponentially. In the context of SIPs, compounding means that the returns earned on the invested amount are reinvested, leading to higher returns in subsequent periods.

Impact of Compounding in SIP

The impact of compounding in SIP investments is significant. As the invested amount grows over time, the returns generated on the initial investment and the reinvested returns contribute to the overall growth of the investment. This compounding effect accelerates wealth creation, especially over long periods.

Benefits of SIP Investment

Financial Discipline

Investing in SIPs instills financial discipline as it requires regular contributions. This disciplined approach helps in building a substantial corpus over time without putting a strain on the investor’s finances.

Flexibility

SIPs offer flexibility in terms of the investment amount and frequency. Investors can start with a small amount and gradually increase their contributions as their financial situation improves. Additionally, SIPs can be paused or stopped without significant penalties, providing flexibility to investors.

Accessibility

SIPs are accessible to a wide range of investors, including those with limited financial resources. The low minimum investment requirement makes it possible for individuals from all walks of life to participate in mutual fund investments.

Professional Management

Investing in SIPs means that the invested money is managed by professional fund managers. These managers have the expertise and experience to make informed investment decisions, maximizing the potential returns for investors.

Diversification

SIPs allow investors to diversify their investments across different mutual fund schemes, reducing risk and enhancing potential returns. This diversification is crucial for minimizing the impact of market volatility on the overall investment.

Conclusion

In conclusion, SIP investments offer a viable path to accumulating ₹1 crore through disciplined, long-term investing. By setting aside just ₹50 daily and leveraging the power of compounding, individuals can achieve significant financial milestones. SIPs provide a range of benefits, including financial discipline, flexibility, accessibility, professional management, and diversification. However, it is essential to be mindful of market volatility, long-term commitment, inflation, and the need for regular monitoring. With the right approach and consistent effort, becoming a millionaire through SIP investments is an achievable goal for many individuals.